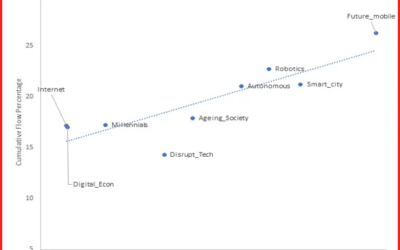

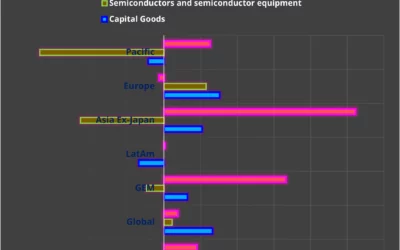

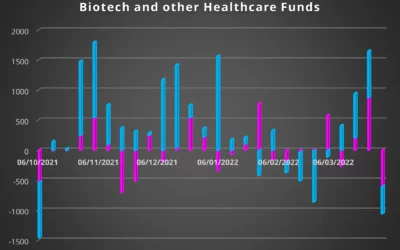

Flows and allocations to different sectors and sector-related fund groups over the past 14 months have been marked by conviction, record inflows – and sharp changes of direction. EPFR’s data also captures some significant thematic shifts.

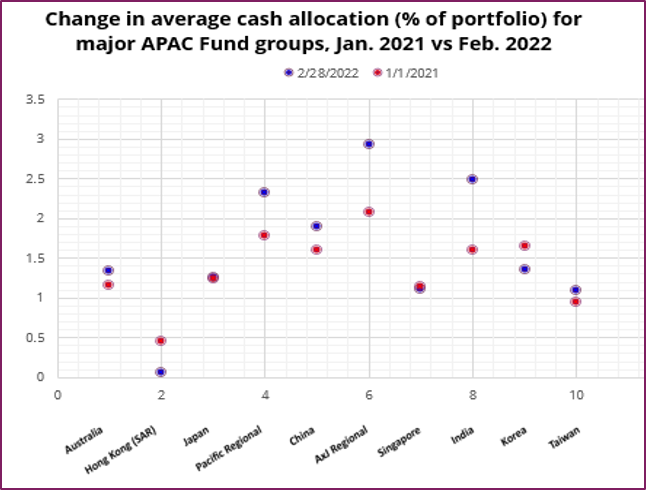

Historically, periods of stress and uncertainty prompt fund managers to shift more of their portfolios into cash. This allows them to meet higher redemption levels and take advantage of oversold names.

Comparing the cash allocations of funds that report their sector weightings among major EPFR-tracked Asia Pacific and Asia ex-Japan Fund groups at the beginning of 2021 with their positions at the end of February, a majority had bigger cash positions going into March. But two groups, Hong Kong (SAR) and Taiwan (POC) Equity Funds, had smaller allocations and those for Japan and Singapore Equity Funds were virtually unchanged.

Over the same period investors have steered over $9 billion into EPFR-tracked China Money Market Funds and nearly $3 billion into India MM Funds. Both Japan and Australia Money Market Funds have posted modest outflows.

Did you find this useful? Get our EPFR Insights delivered to your inbox.