Investors had plenty to look forward to during the first full week of 2024: updated US inflation data, a raft of earnings reports from major investment banks, a general election in Taiwan (POC), and a Securities and Exchange Commission ruling on Bitcoin ETFs.

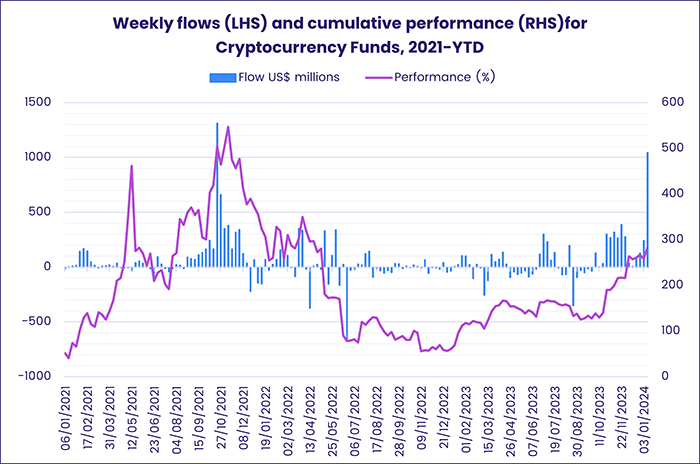

With the first three of these waypoints falling outside the latest reporting period, it was the SEC’s anticipated decision to approve Bitcoin ETFs that left the biggest mark. EPFR-tracked Cryptocurrency Funds posted their biggest inflow since the third week of 4Q21 when the ProShares Bitcoin Strategy ETF was launched.

Elsewhere, investors struggled to get a fix on when, and to what degree, the US Federal Reserve will start cutting interest rates. Optimists scrambled to boost their exposure to both sovereign and corporate debt to capture current yields and position themselves for future capital gains, while pessimists opted against chasing the latest US equity market gains.

Overall, the week ending Jan. 10 saw EPFR-tracked Bond Funds post their biggest collective inflow since the first week of 2Q23 while a net $7 billion flowed out of Equity Funds. Investors pulled a net $55 million out of Alternative Funds and $1.7 billion from Balanced Funds and committed $39.7 billion to Money Market Funds.

At the asset class and single country fund levels, redemptions from Physical Gold Funds climbed to a 14-week high, Mortgage Backed Bond Funds recorded their biggest inflow since late October and Convertible Bond Funds posted their 24th outflow over the past 26 weeks. Italy Bond Funds extended their longest redemption streak since 2Q22, China Bond Funds recorded a third consecutive inflow for the first time in over 22 months and flows into Korea Equity Funds hit a 29-week high.

Emerging markets equity funds

Investors committed another $2.8 billion to the major Asia ex-Japan Country Fund groups during the week ending Jan. 10, helping EPFR-tracked Emerging Markets Equity Funds to run their current inflow streak to six weeks and $12.2 billion. Flows into the diversified Global Emerging Markets (GEM) Equity Funds climbed to a 22-week high as retail share classes attracted the largest amount of new money since mid-July.

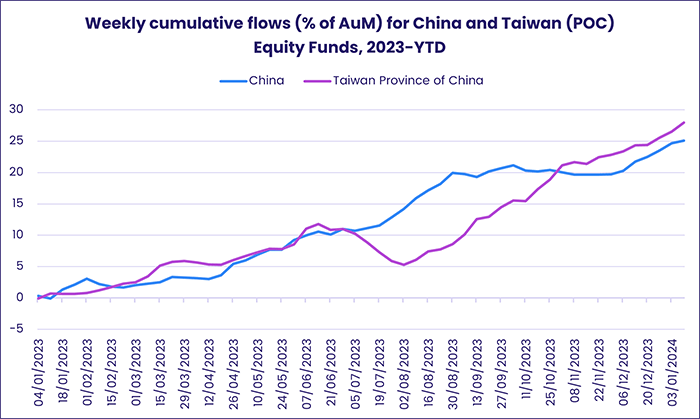

The week also saw Emerging Markets Dividend Funds set a new weekly inflow record as they pulled in fresh money for the 23rd straight week. Taiwan (POC) and China Dividend Funds have been particularly popular, with both absorbing over $3 billion during the past six months.

Taiwan, which China regards as a renegade province, holds legislative and presidential elections on Jan. 13 that are being closely watched because of their geopolitical implications. Although a victory for the Democratic Progressive Party’s William Lai – which polls predict – will be seen by China as a rebuttal of its claims to the island and increase the odds of a more aggressive Chinese stance towards the world’s dominant producer of high-end semiconductor chips, flows to Taiwan Equity Funds remain healthy.

Among fund groups dedicated to smaller Asian markets, Thailand Equity Funds saw redemptions hit a one-year high as political instability and the Thai central bank’s efforts to contain inflation sap the country’s GDP growth.

Latin America Equity Funds, which carried a seven-week run of inflows into late December, posted their second straight outflow. Investors continue to buy into Argentina’s reform story, with dedicated Argentina Equity Funds extending their longest inflow streak since 4Q17, but Mexico-mandated funds have fallen out of favor in early 2024.

After posting their biggest inflow in over three months the previous week, EMEA Equity Funds racked up another outflow – their 15th during the last 20 weeks – as the conflicts in Gaza and Ukraine ground on and oil prices slipped lower. Flows into South Africa Equity Funds did climb to an eight-week high as business confidence climbed and investors debated the timing of interest rate cuts.

Developed markets equity funds

Although major US equity indexes regained momentum during the week ending Jan. 10, investors did not chase them higher. Over $8.5 billion flowed out of US Equity Funds as investors questioned just how much scope the Federal Reserve will have to cut interest rates in 2024 and braced for what is expected to be an underwhelming corporate earnings season.

The redemptions from US Equity Funds, and outflows from Japan, Europe, Canada and Pacific Regional Equity Funds offset solid flows into Global and Australia Equity Funds. That handed EPFR-tracked Developed Markets Equity Funds their first collective outflow of the New Year and only their second since early November.

Having ended 2023 with their first inflow in over nine months, Europe Equity Funds have started 2024 with two straight outflows despite a better-than-expected energy picture, strong labor markets and expectations that the European Central Bank will start cutting interest rates in the second quarter. Retail share classes have not posted a collective inflow since early August and sentiment towards the region’s economic cornerstone, Germany, remains chilly: Germany Equity Funds are currently mired in an outflow streak stretching back to early 3Q23.

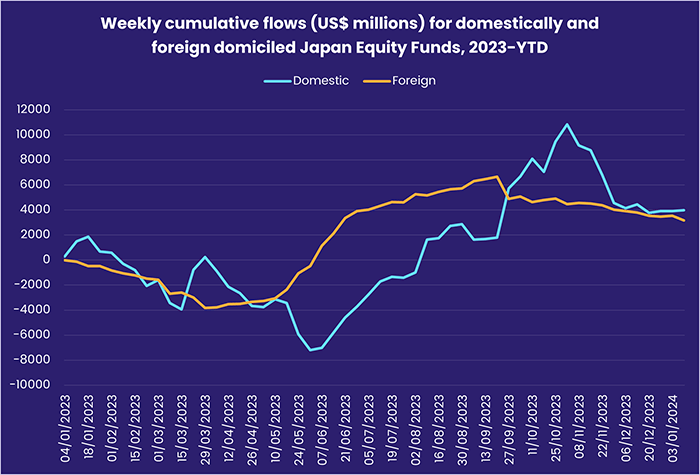

Sentiment towards Japan has also cooled since early November as investors question the willingness and ability of Japanese consumers to spend at a level that keeps inflation at the Bank of Japan’s 2% target. Japan Equity Funds chalked up their seventh outflow over the past 10 weeks, with both foreign and domestically domiciled funds experiencing net redemptions. In the case of funds based overseas, the latest outflow was the biggest in over three months.

US Equity ETFs posted only their third outflow over the past four months during a week where the latest employment data, higher shipping costs and December’s CPI number prompted investors to question earlier assumptions about monetary easing. Leveraged funds recorded their fourth outflow over the past five weeks and US Dividend Funds their fifth since the beginning of December.

Flows into Europe-domiciled Global Equity Funds climbed to a seven-week high, helping the overall group post its second straight inflow. But funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates recorded their 14th outflow since mid-November.

Global sector, industry and precious metals funds

With the “Magnificent Seven” and big banks set to kick off the fourth quarter US earnings season during the tail end of this week, investors upped their commitments to Technology Sector Funds while cutting their exposure to consumer and financial plays. Overall, the number of EPFR-tracked Sector Fund groups reporting inflows rose from three in the past two weeks to five during the week ending Jan. 10.

Driven entirely by flows to ETFs and divided almost equally between US and China-dedicated funds, the latest inflow recorded by Technology Sector Funds was the biggest since August last year. China Technology Sector Funds boasted a 20-week high inflow while US Tech Sector Funds snapped a three-week run of outflows that saw $2 billion exit.

The case for technology funds was boosted by news of the first functional semiconductor made from graphene, a pure carbon extract from graphite which provides a better alternative to silicon where demand is outpacing a struggling supply. After two months of redemptions, EPFR-tracked Semiconductor Funds saw flows climb to a 24-week high, tripling the size of last week’s inflow.

Also recording inflows were Real Estate and Utilities Sector Funds, both of which snapped their latest redemption streaks with the largest inflow since early June 2022 and biggest inflow in 14 weeks, respectively. At the country level, flows to US Real Estate Sector Funds hit a five-week high, Europe Regional-mandated funds saw the largest inflows in a year, and Global Real Estate Sector Funds snapped a 10-week outflow streak. REIT Funds posted consecutive inflows after much of the fourth quarter in negative territory.

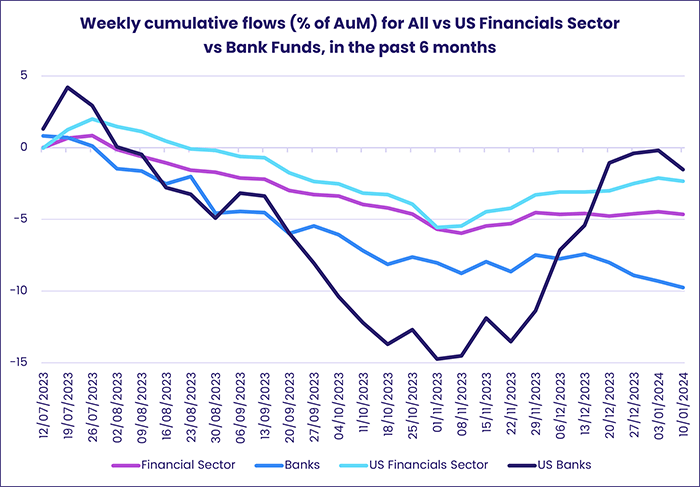

The latest round of bank earnings reports should shed useful light on Interest rate expectations, the outlooks for consumer and corporate credit, the impact of the failures of SVB and Signature Bank and consumer spending. In the run-up, US Financial Sector Funds saw their nine-week, $4 billion inflow streak come to an end. Accounting for 40% of that overall inflow, US Bank Funds have followed a similar trend, but this week, snapped their longest streak of inflows since mid-4Q21.

Energy Sector Funds suffered their 11th straight outflow as the total redeemed during that run moved well past the $6 billion mark. Matching the overall flow trends were Electric Vehicle Funds, with their 13th outflow of the past 14 weeks, while Natural Gas Funds posted their third consecutive and heaviest outflow in 13 weeks, and Solar Funds saw their first outflow in five weeks.

Bond and other fixed income funds

EPFR-tracked Bond Funds ended the first full week of January with a collective inflow of nearly $14 billion as investors looked to get relatively safe yield while it is in offer and position themselves for the capital gains that monetary easing may bring later this year. It was the biggest weekly inflow in nine months and was underpinned by flows into US, Europe, and Global Bond Funds.

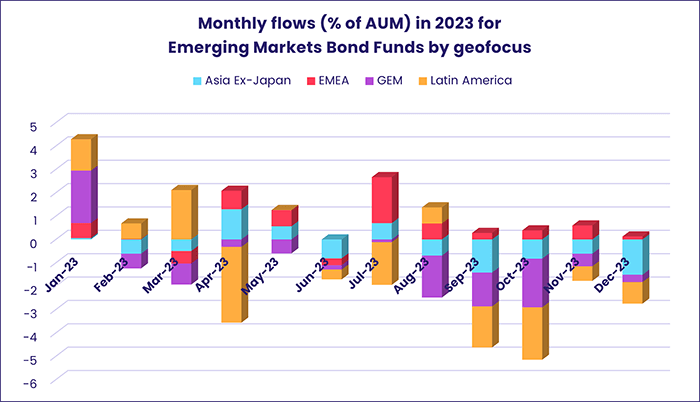

When that easing will begin remains the subject of broad debate, and the latest week saw the end of Emerging Markets Bond Funds’ longest inflow streak – two weeks – since mid-3Q23 and the 64th outflow from Inflation Protected Bond Funds since the beginning of 4Q22.

US Bond Funds recorded their biggest weekly inflow in exactly a year, with the bulk of the fresh money going to funds with corporate and mixed mandates as over $2 billion flowed out of Short Term Treasury Funds. Over the past decade, US Bond Funds have attracted a net $2.28 trillion, with $1.33 trillion of that going to ETFs which underperformed their non-ETF counterparts over the same period by around 400 basis points.

Local currency mandated Emerging Markets Bond Funds pulled in fresh money for the third straight week, but were not able to offset redemptions from hard and mixed currency funds. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did post their first inflow since early October and only their second since the beginning of August.

Investors looking to Europe continue to favor funds offering exposure to corporate debt over those with sovereign mandates. Europe Corporate Bond Funds have taken in more money than Sovereign Funds in eight of the past nine weeks, even though recent sovereign issues on the primary market have been oversubscribed with bid-to-cover ratios ranging from 3.6-to-1 to nearly 10-to-1. Europe Bond Fund retail share classes have recorded net inflows for 18 straight weeks, the longest such run since 1H14.

Among the Asia Pacific Country Fund groups, Australia Bond Funds carried a 29-week inflow streak into November, but since then have posted five outflows over the past 10 weeks. Japan Bond Funds, meanwhile, have chalked up four outflows since the beginning of December as investors wait for signals the Bank of Japan is ready to translate talk of policy normalization into action.

Did you find this useful? Get our EPFR Insights delivered to your inbox.