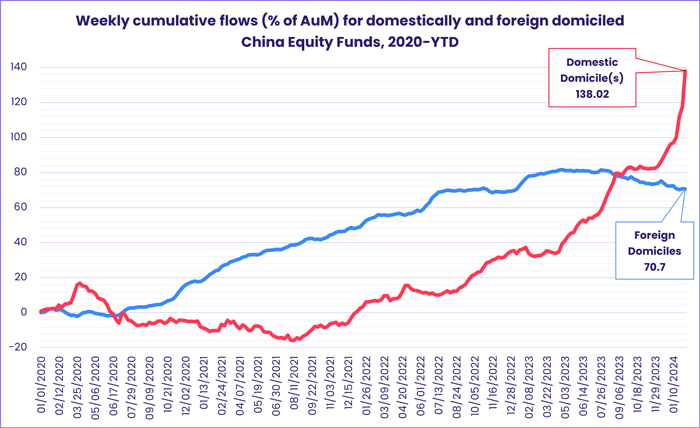

On the eve of the Year of the Dragon, China Equity Funds smashed the weekly inflow record set in early 3Q15 as domestic institutional investors steered over $19 billion into the group.

The influx of fresh money arrested the decline of China’s benchmark stock index, the CSI 500, which hit its lowest level since 1Q19 on February 5 before climbing 650 points over the following two days. Meanwhile, on the other side of the Pacific, investors cashed out of US Equity Funds as the S&P 500 index made a run at the 5,000-point mark.

Overall, a net $5.6 billion flowed into all EPFR-tracked Equity Funds during the week ending Feb. 7. Alternative Funds absorbed $90 million, Bond Funds $13.3 billion and Money Market Funds $40 billion. Investors pulled another $2.2 billion out of Balanced Funds as that group chalked up its 51st outflow over the past 12 months.

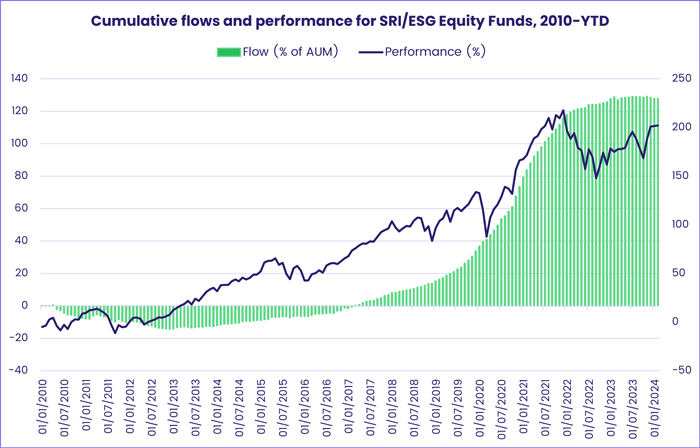

Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their eighth consecutive outflow, the longest such run since 3Q12, while SRI/ESG Bond Funds recorded their ninth inflow over the past 10 weeks.

At the asset class and single country fund levels, Total Return Funds extended their longest inflow streak since 1Q23, Cryptocurrency Funds posted their 18th inflow since the beginning of October and High Yield Bond Funds posted their 14th inflow over the past 15 weeks. Flows into Qatar Equity Funds hit a 113-week high, Australia Bond Funds posted their biggest inflow since late October and South Africa Money Markets recorded their largest weekly inflow since early 4Q20.

Emerging markets equity funds

The first week of February saw EPFR-tracked Emerging Markets Equity Funds post a new weekly inflow record that had obvious Chinese characteristics. Although all four of the major groups recorded an inflow, as did Frontier Markets and BRIC (Brazil, Russia, India and China) Funds, it was the nearly $20 billion that flowed into dedicated China Equity Funds that underpinned the headline number.

While a record in US$ terms, in % of AUM terms the latest week’s total was the biggest since the penultimate week of 2008, when key emerging markets were cutting interest rates and unveiling stimulus plans to sustain growth rates that were well above those found in most developed markets.

The latest flows into China-mandated funds went predominately to domestically domiciled ETFs as Chinese policymakers move to put a floor under an equity market that has lost over $6 trillion in value over the past three years. Measures include increased buying from China’s sovereign wealth fund, curbs on short selling and new leadership for the China Securities Regulatory Commission.

While Chinese equity markets continue, for multiple reasons, to dominate the financial headlines, fresh cash continues to flow into India Equity Funds. During the first week of February, they absorbed over $900 million as they recorded their third-largest inflow since EPFR started tracking them weekly in 4Q00.

Latin America Equity Funds chalked up their first inflow of the year despite further redemptions from Brazil Equity Funds as investors take profits from a market that was up over 20% in 2023. Argentina Equity Funds added to their current inflow streak ahead of the first legislative reverse for reformist President Javier Milei’s agenda.

Flows into EMEA Equity Funds hit their highest weekly total since mid-2Q23 with solid commitments to Turkey Equity Funds the biggest contributor to the headline number. But redemptions from South Africa Equity Funds came in at a one-year high as interest rates and unemployment continue to weigh on the country’s economy, raising the chances that the ruling African National Congress (ANC) may require the support of the radical Economic Freedom Fighters Party after this summer’s general election.

Developed markets equity funds

While China Equity Funds were absorbing record-setting sums against the backdrop of a market struggling to pull out of a long slump, US Equity Funds experienced their heaviest redemptions since mid-September as key indexes hit new highs. As a result, EPFR-tracked Developed Markets Equity Funds started February by posting their biggest outflow year-to-date.

Canada, Japan, Australia and Global Equity Funds did attract fresh money during the week ending Feb. 7. But, in addition to the redemptions from US Equity Funds, investors pulled another $1.7 billion out of Europe Equity Funds.

The latest outflow posted by Europe Equity Funds was their 47th during the past 48 weeks, a window that has seen over 5% of the group’s asset base redeemed. Sentiment has been sapped by multiple issues, with the struggles of the German economy currently taking center stage. At the country level, Germany Equity Funds racked up their 30th consecutive outflow and funds dedicated to Nordic markets struggled, with outflows from Sweden, Finland and Denmark Equity Funds climbing to six-week, 56-week and record highs, respectively.

Among US Equity Funds groups, redemptions from Large Cap Blend Funds roughly matched the flows into that group during the previous week. According to EPFR Liquidity Analyst Winston Chua, the ratio between corporate buying of existing equity (share buybacks and cash purchases) and selling of new shares hit 10-to-1 in early February while selling by insiders required to file Form 4 with the Securities and Exchange Commission (SEC) is running at 12 times the value of shares bought.

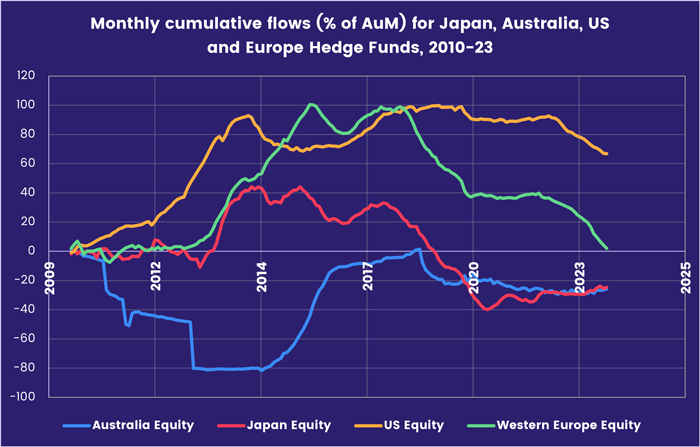

Investors using Hedge Funds to get developed markets equity exposure have pulled back from US and Europe-mandated funds while showing more appetite for ones dedicated to the developed Asian markets.

Conventional Japan Equity Funds added to their current inflow streak, with funds domiciled overseas taking in more money than their domestically based counterparts for the third time in the past four weeks. Recent wage and household data suggest the Bank of Japan will not feel any pressure to start normalizing its ultra-accommodative monetary policies when it meets in March.

Global Equity Funds, the biggest of diversified Developed Markets Equity Fund groups, extended their longest inflow streak since 1Q23 while Pacific Regional Equity Funds snapped their longest outflow streak in over three years.

Global sector, industry and precious metals funds

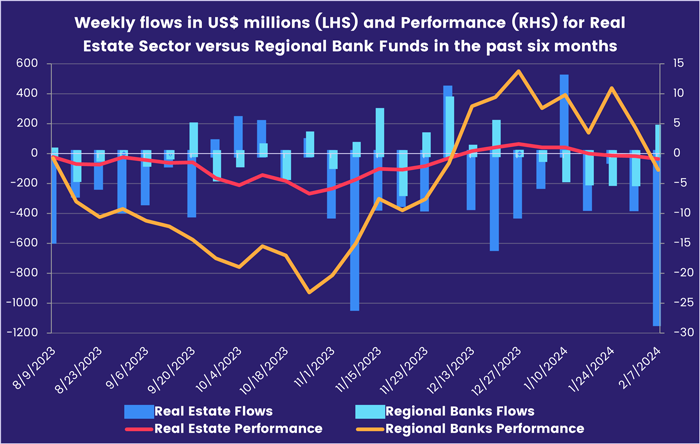

In the first week of February, five out of the 11 major EPFR-tracked Sector Fund groups reported inflows ranging from $101.3 million for Telecoms Sector Funds to $1.32 billion for Consumer Goods Sector Funds. But the return of the higher-for-longer interest rate narrative kept the pressure on the real estate sector and the banks that lend to it, spurring redemptions for Real Estate Sector Funds that exceeded $1 billion.

While the post-pandemic work-from-home trend and half empty offices have sent repeated chills through real estate markets, especially commercial ones, US Treasury Secretary Janet Yellen concluded recently that it poses no systematic risk to the banking system. But Real Estate Sector Funds started February by suffering their heaviest outflows since May 2022. A custom group of nine Regional Bank Funds did snap their five-week, $774.6 million outflow streak.

The broader sector that contains regional banks, Financials Sector Funds, posted their heaviest outflow in over three months. While US-dedicated funds pulled the headline number down, Canada Financials Sector Funds extended their inflow streak to five weeks and $638 million total.

Among the other cyclical sector funds, Technology Sector Funds were the only group to attract inflows. Although this week marked the smallest inflow of the group’s five-week streak, it did bring the total of this run up to $9.5 billion.

On the defensive side, Consumer Goods Sector Funds brought an end to their eight-week redemption streak that cost the group $4 billion with their biggest inflow since mid-April 2023. US Consumer Goods Sector Funds absorbed nearly $2 billion this week, while global and China-dedicated funds saw a combined $570 million flow out.

At the fund-level, the top 10 funds ranked by inflows were all ETFs with three staples-focused funds and two consumer discretionary mandated funds while the other five have ties to home building & construction or electric vehicle bellwether Tesla. A custom group of 10 Tesla-focused funds within the Consumer Goods Sector have seen momentum pick up recently, attracting $307 million (or 64% of assets) over the past seven weeks.

Bond and other fixed income funds

Coming into February, fixed income investors swallowed their disappointment with the caution exhibited by central bankers when it comes to cutting interest rates. Instead, they refocused their attention on the ‘soft landings’ those central bankers are trying to engineer and the higher yields currently on offer from relatively safe asset classes.

The week ending Feb. 7 saw year-to-date flows into all EPFR-tracked Bond Funds climb past the $70 billion mark as US, Global and Europe Bond Funds posted their seventh, 13th and 14th consecutive inflows, respectively, while Emerging Markets Bond Funds chalked up their second inflow of 2024 and biggest since the third week of 2Q23. At the same point last year, collective inflows totaled $82 billion.

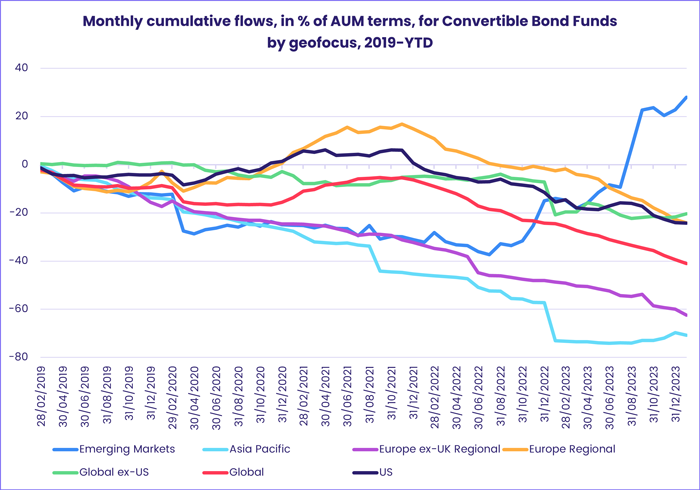

At the asset class level, Bank Loan Funds took in fresh money for the 15th time over the past 18 weeks and High Yield Bond Funds for the 14th time during the past 15 weeks, Total Return Funds extended their current inflow streak to eight weeks and $14.8 billion and Municipal Bond Funds added to their longest run of consecutive inflows since 1Q22. Investors pulled money out of all Convertible Bond Funds for the fifth week running and 31st time since the beginning of July but Convertible Contingent (CoCo) Bond Funds have recorded inflows four of the past seven weeks.

US Bond Funds started February with the biggest inflow to their retail share classes since late 1Q20. Corporate and Sovereign Funds both recorded modest outflows for the week while flows into US Mixed Bond Funds hit their highest weekly total in 30 months. Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates posted their seventh consecutive inflow.

Flows into Europe SRI/ESG Bond Funds were positive for the sixth week running and funds with corporate debt mandates again attracted more money than their sovereign counterparts. At the country level, redemptions from UK and Switzerland Bond Funds hit 11 and 24-week highs while flows to Germany Bond Funds climbed to a YTD high.

Among the Emerging Markets Bond Fund groups, Sharia Bond Funds posted consecutive weekly inflows for the first time since mid-September, Frontier Markets Bond Funds saw their longest inflow streak in over two years come to an end and Global Emerging Markets (GEM) Bond Funds recorded their biggest inflow since the third week of November.

Did you find this useful? Get our EPFR Insights delivered to your inbox.