With millions of Chinese workers downing tools for the Lunar New Year holiday and the country’s stock market going into that break on the back of five straight daily gains, attention shifted to the US during the second week of February. Among the waypoints for investors were the breaking of the 5,000-point level by the benchmark S&P 500 index, a higher than hoped for inflation reading for January and the emergence of a new label – no landing – for America’s economic trajectory.

Against this backdrop, flows into US Equity Funds hit a seven-week high and US Bond Funds recorded their eighth consecutive inflow while US Money Market Funds posted their second outflow of the year-to-date.

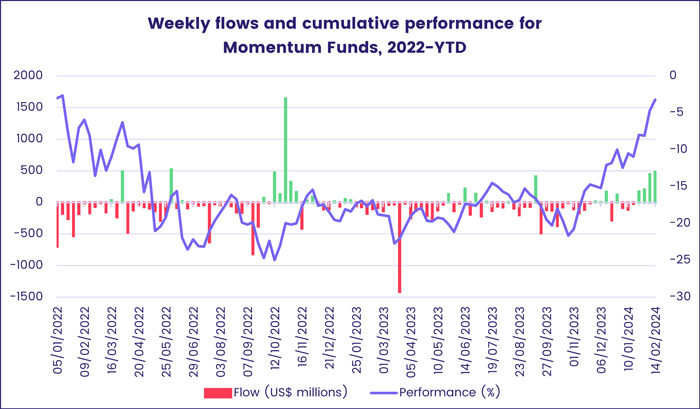

Despite the financial industry’s classic disclaimer that past performance is no guarantee of future returns, it was another good week for Momentum Funds. These funds, which seek to capture the gains that outperforming stocks deliver as more investors jump on their bandwagons, chalked up their biggest inflow in over 15 months as they extended their longest inflow streak since 4Q22.

Elsewhere, it was another lackluster week for Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates. Money left these funds for the ninth week running, their longest run of redemptions in over 11 years, as major asset managers scale back their earlier commitments to put pressure on climate-unfriendly companies.

Overall, the week ending Feb. 14 saw EPFR-tracked Equity Funds absorb a net $16 billion and Bond Funds $11.6 billion while Alternative Funds attracted $2.7 billion. Investors pulled $3.4 billion out of Balanced Funds and $18.4 billion out of Money Market Funds, with the headline number for the latter group driven by the $13 billion redeemed from Europe Money Market Funds

At the asset class fund level, Physical Gold Funds posted their seventh consecutive outflow and Silver Funds their eighth over the past nine weeks while Cryptocurrency Funds set a new inflow mark as Bitcoin prices moved north of $50,000 and the universe of trackable funds continues to expand.

Emerging markets equity funds

It was more of the same for EPFR-tracked Emerging Markets Equity Funds during the second week of February as China and India-mandated funds again attracted the lion’s share of the money that did flow in, and EM Dividend Funds racked up their 28th consecutive inflow. Latin America and the diversified Global Emerging Markets (GEM) Equity Funds both experienced net redemptions, while EMEA and Frontier Markets Funds posted inflows.

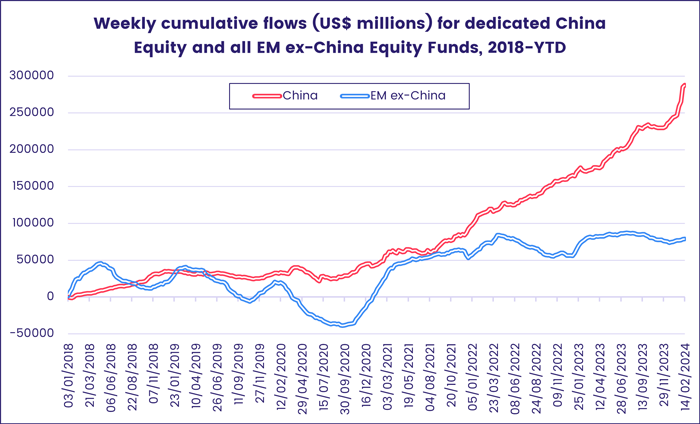

Although flows to China Equity Funds were less than a sixth of the previous week’s record-setting total, they lifted the year-to-date total over the $44 billion mark. In 2023, the group attracted a net $77 billion. For all the talk of a pivot away from China, and the strong flows enjoyed by a handful of US-domiciled GEM ex-China ETFs, overall flows to all EM ex-China Funds have been flat since 2Q22.

Elsewhere, India Equity Funds extended their record-setting inflow streak to 48 weeks and over $35 billion total while flows into Indonesia Equity Funds climbed to a 42-week high as Prabowo Subianto emerged as the presumptive winner of the recent presidential election. The current Defense Minister has promised to maintain the economic policies of President Joko Widodo, whose term ends in October.

EMEA Equity Funds posted consecutive weekly inflows for only the second time during the past six months as cautious enthusiasm for Turkey’s painful reacquaintance with orthodox monetary policy and its stock market’s blistering ascent offset doubts about the outlook for oil prices. While Turkey Equity Funds chalked up their sixth inflow since late December, outflows from Saudi Arabia Equity Funds climbed to a 16-week high.

Having posted their first inflow of the year the previous week, Latin America Equity Funds experienced further redemptions with Brazil Equity Funds taking the biggest hit.

Developed markets equity funds

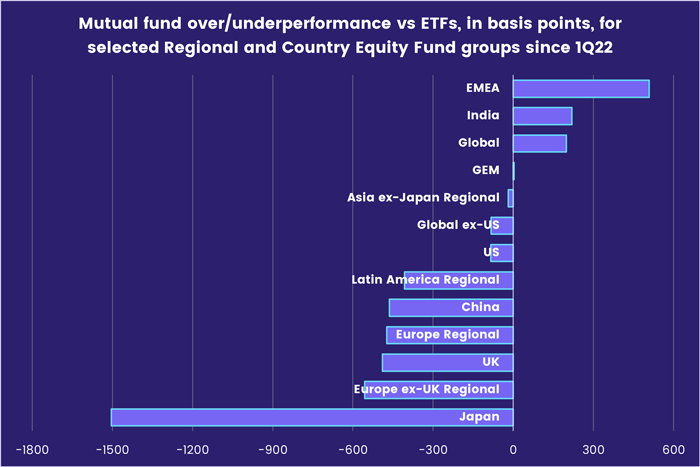

Flows to US Equity Funds rebounded during the second week of February, helping EPFR-tracked Developed Markets Equity Funds post their third collective inflow during the past four weeks. Global, Japan and Australia Equity Funds also attracted fresh money. That money again gravitated to ETFs, with non-ETFs posting their 57th consecutive collective outflow.

When it comes to relative performance over the past 25 months, Global Equity Funds are the only Developed Markets Equity Fund group where ETFs have not outperformed mutual funds.

Japan Equity ETFs have the biggest lead over their non-ETF peers during that period. The latter saw a three-week run of inflows come to an end as Japan Equity Funds overall absorbed fresh money for the fifth straight week. The latest inflows came ahead of data showing the country’s economy slipped into a technical recession during 4Q23 and lost its crown as the world’s third-largest economy to Germany. With weak domestic consumption a major factor in the fourth quarter reading, the Bank of Japan has further reasons to delay any normalization of its current policies.

While Germany has leapfrogged Japan, it has economic problems of its own – a contracting property sector, weaker Chinese demand for its exports – that cast a shadow over the region as a whole. During the latest week, Europe Equity Funds recorded their 48th outflow since early March of last year while Germany Equity Funds chalked up their 31st consecutive outflow. Ireland Equity Funds did post their biggest inflow since early 2Q23 and Switzerland Equity Funds since mid-November.

US Equity Funds with mixed style mandates dominated the flows for this group during the latest week. Small Cap Growth, Mixed and Value Funds were, in that order, the week’s best performing groups. However, among Canada Equity Funds those with small cap value mandates were the worst performers.

Global sector, industry and precious metals funds

With the first half of 1Q24 under investors’ belts, above target inflation still lurking and recessionary fears turning to reality in Japan and Europe, two of the 11 EPFR-tracked Sector Fund groups – Energy and Consumer Goods Sector Funds – endured outflows in excess of $1.3 billion during the second week of February. Four groups did receive inflows ranging from $27 million for Telecoms Sector Funds to $2.34 billion for Technology Sector Funds.

As Russia’s invasion of Ukraine approaches the two-year mark, many of the gloomiest predictions about energy supplies – both to Europe and globally – remain unfulfilled with investors worrying about weak demand for oil and growing supply. The outlook for natural gas may be brighter, with European energy major Shell forecasting demand for liquified natural gas (LNG) will soar by 50% over the next 15 years and Natural Gas Funds seeing inflows for the fourth straight week with the latest reaching a 10-week high.

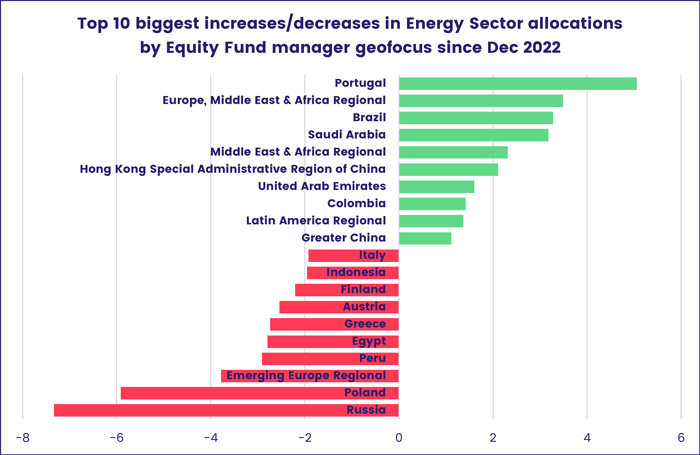

The latest sector allocations data shows that energy stocks now account for 10% of the average Portugal Equity Fund portfolio, the biggest increase among equity funds managers since Dec 2022. Russia Equity Fund managers had the heaviest decrease in allocation to energy stocks, but still have them accounting for 32% of their average portfolio.

For the fourth time in the seven weeks year-to-date, flows into Technology Sector Funds have topped $2 billion. This happened only twice in the first 12 weeks of 2022, but eight times in 1Q21. Of the major subgroups attracting inflows this year, investors have pumped over $1.5 billion into Semiconductor Funds and another $1 billion into Artificial Intelligence Funds.

The heavy inflows that Consumer Goods Sector Funds experienced last week quickly reversed as the group suffered its heaviest redemption since late 4Q20. The same staples-focused ETF that accounted for roughly 60% of last week’s inflow was responsible for $1.2 billion in outflows – or nearly 90% of the headline number – this week.

Redemptions for Commodities/Materials Sector Funds exceeded $840 million for a second consecutive week, again, driven by US and Global-dedicated funds.

Bond and other fixed income funds

EPFR-tracked Bond Funds continued their solid start to 2024 during the week ending Feb. 14, absorbing another $11 billion that took their year-to-date total to $83 billion. Among the major groups by geographic focus, only Emerging Markets Bond Funds ended the week with an outflow while Global Bond Funds posted their third straight inflow of over $2 billion, Europe Bond Funds extended an inflow streak stretching back to the beginning of November and flows into Asia Pacific Bond Funds climbed to a three-month high.

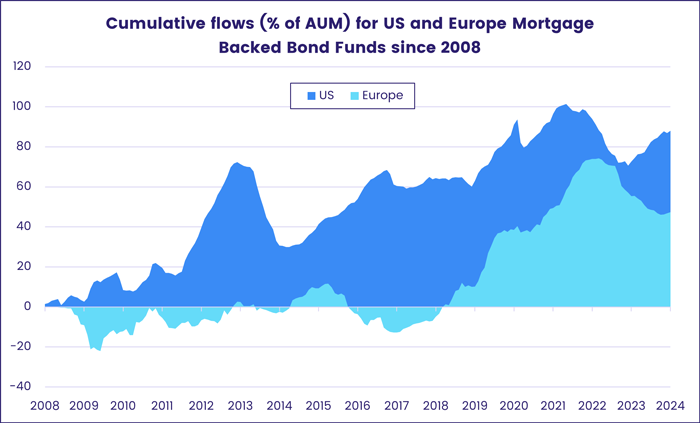

At the asset class level, Convertible Bond Funds saw money flow out for the 45th time since the beginning of 3Q23 and Inflation Protected Bond Funds posted consecutive weekly outflows for the first time this year while flows into Bank Loan Funds hit a YTD high and High Yield Bond Funds recorded their 15th inflow during the past 16 months. Investors also steered another $620 million into Mortgage-Backed Bond Funds.

Investors looking for emerging markets exposure again gravitated to Emerging Markets Local Currency Bond Funds, but those inflows were offset by the 10th outflow from their hard currency counterparts since the beginning of December. Over the past 12 months, US-domiciled Emerging Markets Bond Funds have seen over $40 billion flow out while redemptions from Europe-domiciled funds are running at an eighth of that total.

Foreign-domiciled US Bond Funds have absorbed fresh money for seven straight weeks and 10 of the past 12 as YTD flows into the overall group climbed towards the $50 billion mark. Retail share classes were in the money for the sixth time so far this year, and US Bond Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates have not recorded an outflow since the third week of December.

Demand for US treasuries has been solid, with recent auctions seeing bid-to-cover ratios of over 2 and demand in the primary market for sovereign issues has been even stronger.

Europe Bond Funds posted their 15th straight inflow, although the pace of those inflows dropped for the second week running, as investors retained their preference for corporate debt. Redemptions from Europe Sovereign Bond Funds hit their highest level since mid-4Q22. Among the single country groups, Denmark Bond Funds set a new weekly inflow record on the back of flows to a single domestically domiciled fund, while redemptions from Greece and Germany Bond Funds hit a 10 and 11-week highs, respectively.

Did you find this useful? Get our EPFR Insights delivered to your inbox.