The flash of animal spirits that followed the US Federal Reserve’s final policy meeting of 2023 in mid-December carried equity markets higher for much of the following week. But mutual fund flows during the third week of December painted a picture of investors closing up shop for the year rather than chasing the latest surge in US, European and Japanese equity markets.

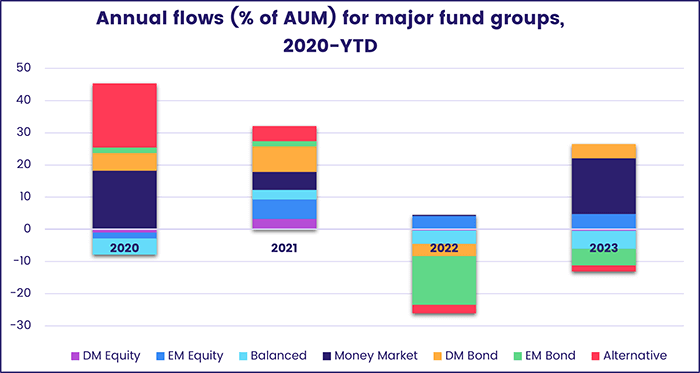

Interest in Latin America and the two biggest emerging Asian markets helped Emerging Markets Equity Funds extend their current inflow streak. But Money Market, Developed Markets Equity and Bond, Alternative, Balanced and Emerging Markets Bond Funds all recorded outflows for the week ending Dec. 20 that collectively added up to over $55 billion.

Equity Funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates saw over $1 billion flow out for the 10th time as the group, which only posted two weekly outflows between the third week of January 1Q19 and the third week of February 2022, experienced net redemptions for the 21st time year-to-date.

At the asset class and single country fund levels, redemptions from Mortgage Backed and Inflation Protected Bond Funds hit seven and 35-week highs, respectively, while both High Yield Bond and Cryptocurrency Funds extended their longest inflow streaks since 2H21. Investors pulled money out of all five Europe Country Equity Fund groups dedicated the ‘Frugal Five’ markets – Austria, Finland, Denmark, the Netherlands and Sweden – and removed over $1 billion from UK Equity Funds.

Emerging markets equity funds

The third week of December saw another $2 billion flow into China Equity Funds while India Equity Funds took in over $1 billion for the first time since EPFR started tracking them in 4Q00. That paved the way for Emerging Markets Equity Funds to post a third consecutive inflow for the first time since early October.

Retail investors continue to keep their distance from this asset class, with money flowing out of retail share classes for the 20th week running. But Emerging Markets Dividend Funds remain popular. They have taken in over $6 billion since early August.

The latest flows into China Equity Funds went exclusively to domestically domiciled funds. Those domiciled outside mainland China posted their biggest collective outflow since the third week of August as the benchmark Shanghai Composite index closed below 3,000 points for the first time in over 14 months, reflecting disappointment at the Chinese government’s reluctance to meet the threat of deflation with aggressive fiscal and monetary stimulus.

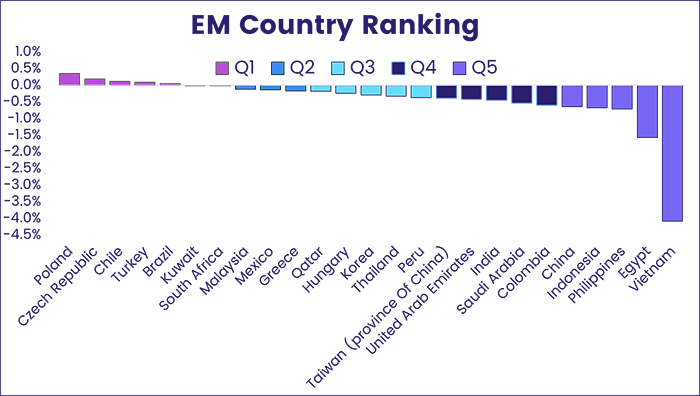

India Equity Funds, meanwhile, set a new weekly inflow mark at the country’s economy grows at a more than 7% clip and its benchmark equities index is up over 15% year-to-date. But nether India nor China are close to the top of EPFR’s weekly EM rankings, which are based on flows to funds with cross-border mandates.

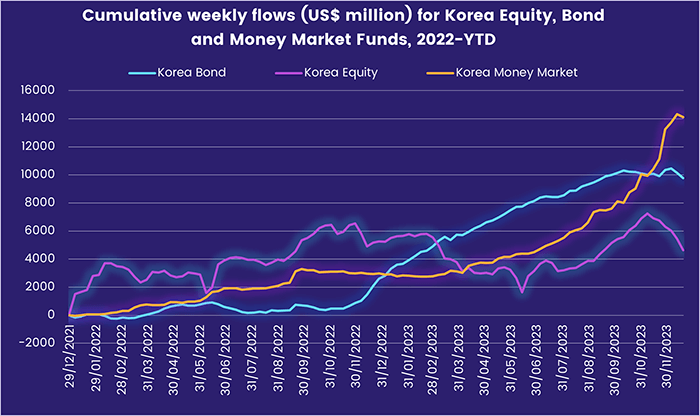

South Korea, which is wrestling with a range of issues from record levels of consumer debt to the saber-rattling of North Korea, is also in the bottom half of the rankings. Investors are cutting dedicated exposure to this market for a variety of asset classes. During the latest week, redemptions from Korea Equity Funds hit a 26-week high and Korea Bond Funds posted their biggest outflow since early 1Q21.

Among the Latin America Country Fund groups, Argentina’s economic story and Brazil’s falling interest rates are playing well with investors. Argentina Equity Funds extended their longest run of inflows since mid-1Q23 and Brazil Equity Funds pulled in over $150 million.

Money flowed out of EMEA Equity Funds for the 13th week since the beginning of September. The headline numbers for several regional groups hit multi-week highs in both directions, but these were driven by money entering and leaving funds managed by a single provider.

Developed markets equity funds

Flows to EPFR-tracked Developed Markets Equity Funds swung from positive to negative during the third week of December as technical factors, the approaching Christmas holidays and concerns about the latest developments in the Middle East prompted investors to step back. All of the major groups posted outflows that ranged from $38 million for Australia Equity Funds to $10.4 billion for US Equity Funds.

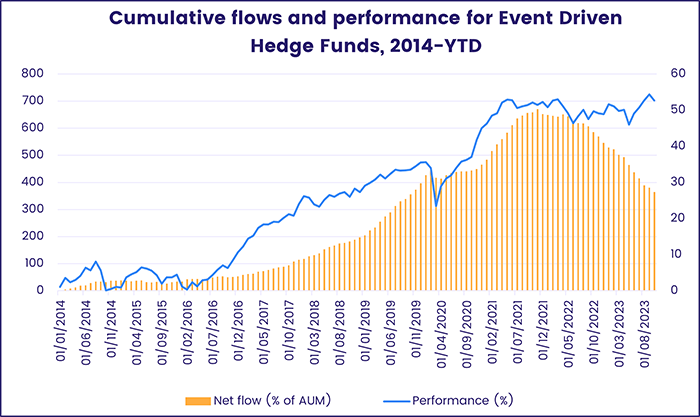

In the case of US Equity Funds, the flow picture was colored by funds going ex-dividend and the expiring of futures and options contracts on Dec. 15. Meanwhile, major US companies continue to aggressively support their share prices by way of buybacks. Research by EPFR Liquidity Analyst Winston Chua indicates that the value of announced buybacks year-to-date is approaching the $1 trillion mark and that the ratio of existing shares retired to new shares sold is running at 5.7-to-1.

This heavy focus on one type of corporate action has dented investor appetite for event-driven hedge fund strategies. These funds, which seek to identify and take advantage of share prices that do not accurately reflect the impact of corporate actions – mergers, acquisitions, etc. – on the issuer, have seen flows drop off since the middle of last year.

The largest outflows from UK and Germany Equity Funds since mid-July and late 1Q21, respectively, helped extended Europe Equity Funds‘ 41-week redemption streak as they offset the strongest flows into Europe ex-UK Regional Funds in over 22 months. The week also saw funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates record their biggest inflow since the second week of July.

Japan Equity Funds posted their sixth outflow over the past seven weeks. But fears that the Bank of Japan would use its final policy meeting of 2023 to start normalizing its ultra-accommodative policies proved – once again – to be premature as BOJ Governor Kazuo Ueda stressed the lack of evidence to support such a step.

Global sector, industry and precious metals funds

Investor appetite for additional sector exposure remained at a low ebb going into the Christmas and New Year holidays. During the week ending Dec. 20, only one of the 11 major EPFR-tracked Sector Fund groups, Telecom Sector Funds, recorded an inflow while the other 10 experienced outflows that ranged from $31 million for Industrial Sector Funds to $1.5 billion for Healthcare/Biotechnology Sector Funds.

Among the drivers of the persistent outflows from Healthcare/Biotechnology Funds are the waning expenditure on anti-Covid measures and fears that provisions in the US Inflation Reduction Act aimed at controlling drug prices will begin to bite in 2024.

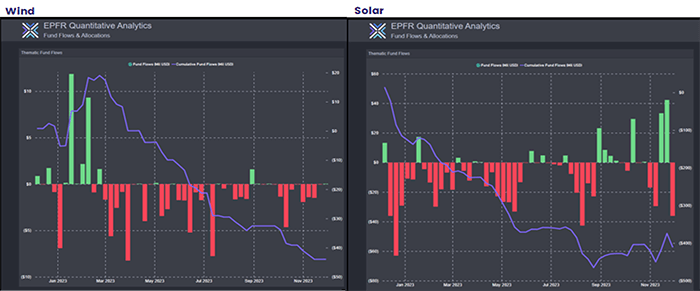

Despite predictions that tensions in the Middle east will drive oil and natural gas prices higher, Energy Sector Funds chalked up their eighth consecutive outflow. Investors remain uncertain about global demand, the impact of the latest climate pledges and the willingness of cash-strapped governments to subsidize clean energy providers. In the case of the latter, dedicated Solar Funds have attracted some fresh money in recent weeks thanks to the flexibility and lower capital costs of solar technology compared to building and operating wind turbines.

Technology Sector Funds posted their first outflow since the final week of October and their biggest since early September as higher capital costs, potentially destabilizing layoffs among US firms, Sino-US tensions, and uncertainty about proposals to regulate artificial intelligence weigh on investor confidence.

Consumer confidence and ability to spend in the face of higher mortgage payments and other borrowing costs remain a concern for many investors. Consumer Goods Sector Funds chalked up their 16th outflow during the past 20 weeks and their biggest in over 20 months.

Year-to-date, Telecoms Sector Funds narrowly lead Technology Sector Funds as the best performing group while Utilities and Healthcare/Biotechnology Sector Funds are at the bottom of the table when it comes to collective performance.

Bond and other fixed income funds

With investors scrambling to adjust their assumptions about major central bank pivot points in the wake of the US Federal Reserve’s final policy meeting of 2023, redemptions from US Bond Funds hit a one-year high during the third week of December.

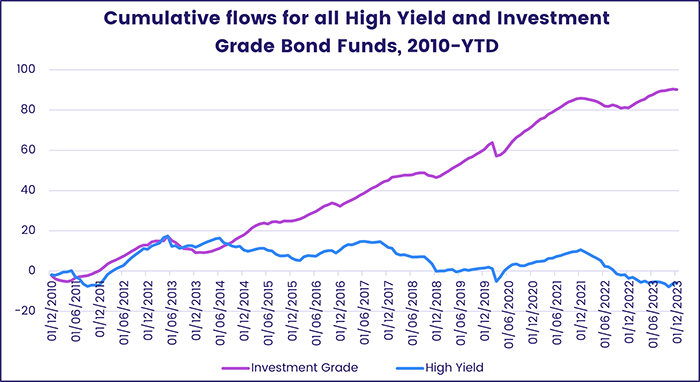

Behind the headline number for US Bond Funds were continuing rotations from short to long term and investment grade to high yield. US High Yield Bond Funds have fared better – in flow terms – than their investment grade counterparts in six of the past seven weeks while the latest redemptions from US Short Term Bond Funds were the biggest since the first week of 2Q22.

Inflation Protected Bond Funds continue to see money flow out as price indexes on both sides of the Atlantic drop closer to central bank targets. Having absorbed $138 billion between the first month of 2Q20 and the final month of 1Q22, this fund group has seen $75 billion redeemed since April of last year.

Expectations of lower US and European inflation and interest rates have not, so far, translated into stronger investor appetite for emerging markets debt. The latest week saw another $1.1 billion flow out of Emerging Markets Bond Funds, the bulk of which was pulled out of local currency mandated funds with an emerging Asian focus. Redemptions from both dedicated Korea and Thailand Bond Funds exceeded $350 million while China Bond Funds posted their 47th outflow year-to-date as another major real estate borrower sought bankruptcy protection in the US.

Europe Bond Funds eked out a modest inflow with Europe ex-UK Regional and Denmark Funds the biggest contributors to the headline number. Funds with corporate mandates outgained their sovereign counterparts for the sixth time in the past seven weeks.

After several weeks where both of the major multi asset fund groups experienced consistent outflows, Total Return Funds have begun to attract some fresh money with latest week’s inflow the biggest since early May. Balanced Funds have not recorded a weekly inflow since early April.

Did you find this useful? Get our EPFR Insights delivered to your inbox.