Investors have a lengthy wish list for 2024. On it are lower US and Eurozone interest rates, more aggressive stimulus measures by Chinese policymakers, fewer – if any – geopolitical shocks, the monetization of artificial intelligence’s promise and the ‘normalization’ of politics in America, Europe and key emerging markets.

Going into the final days of 2023, those investors showed a willingness to back the lower interest rates and greater Chinese stimulus narratives. During the fourth week of December China Equity Funds posted their fifth straight inflow and US Equity Funds their 11th over the past 12 weeks while Europe Equity Funds recorded their first weekly inflow in over 10 months and China Bond Funds their biggest in over 22 months.

The appetite for protection against inflation remains limited at best and, when present, is benefiting Cryptocurrency Funds over more traditional alternatives. The latest week saw that group take in fresh money for the 13th week running as Inflation Protection Bond Funds extended a redemption streak stretching back to the beginning of September.

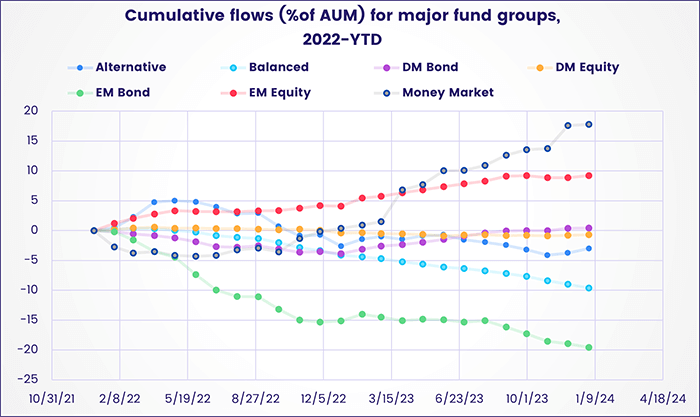

Overall, EPFR-tracked Bond Funds took in a $6.7 billion during the week ending Dec. 27 while $15.4 billion flowed into Money Market Funds and $19.9 billion into Equity Funds. A net $288 million was redeemed from Alternative Funds and $2.6 billion from Balanced Funds.

Among the fund groups that, based on preliminary data for December, posted new full-year inflow records are US and Korea Money Market Funds, China and India Equity Funds and South Africa, Italy and Korea Bond Funds. Setting new full-year redemption marks were UK, Poland and Austria Equity, Balanced, Malaysia and Hong Kond Bond and Global Money Market Funds.

Emerging markets equity funds

Although the inflows recorded by China and India Equity Funds drove the headline for all EPFR-tracked Emerging Markets Equity Funds during the fourth week of December, there were signs that investors are taking a broader interest in the overall asset class. The diversified Global Emerging Markets (GEM) Equity Funds recorded only their third inflow since the beginning of August and EMEA Equity Funds their first since late October while retail shares recorded net inflows for the first time in five months.

Emerging Markets Dividend Funds maintained their strong end to the year, posting their 21st consecutive inflow. But redemptions from funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates hit an eight-week high.

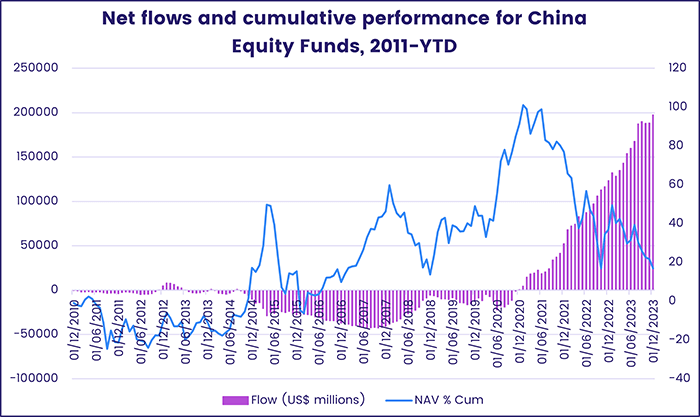

China Equity Funds recorded their fifth straight inflow despite over $1 billion flowing out of foreign domiciled funds for the second week running, the first time that has happened since late 1Q20. Although this fund group has attracted by far the largest inflow of any EM Country Fund group, their collective performance is the worst of any group bar sanction-frozen Russia Equity Funds.

GEM Equity Fund managers have responded to this lackluster performance by dropping their average allocation to China – which rebounded sharply coming into 2023 – to its second-lowest level since 3Q17. They have also treated India’s more bullish story with a degree of caution: despite strong market performance and record-setting flows into dedicated India Equity Funds, they have cut their allocation to this market for two consecutive months.

EMEA Equity Funds posted a rare week of inflows on the back of solid commitments to Turkey Equity Funds, which chalked up their first inflow since the second week of November and biggest since the second week of October. Despite aggressive interest rate hikes aimed at curbing an inflation rate that hit 80% late last year, the country managed nearly 6% GDP growth in the third quarter and its benchmark equity index is up over 30% year-to-date.

A seven-week run of inflows came to an end for Latin America Equity Funds in late December as redemptions for dedicated Brazil and Latin America Regional Funds offset flows into Mexico and Argentina Equity Funds. In the case of the latter groups, investors are buying into Argentina’s nascent reform story and Mexican GDP growth that has consistently exceeded expectations.

Developed markets equity funds

EPFR-tracked Developed Markets Equity Funds went into the final days of 2023 having posted seven inflows during the past eight weeks. That trend was largely driven by renewed appetite for exposure to the US, where expectations of an economic ‘soft landing’ have been bolstered by the Federal Reserve’s dovish tone, with Global, Europe and Japan Equity Funds struggling to attract fresh money.

Overall, all DM Equity Funds remain on track for their biggest yearly outflow since 2020 as the over $430 billion committed to ETFs was more than offset by redemptions from non-ETFs. This will also be the sixth straight year that EM Equity Funds have fared better, in terms of net flows, than their DM counterparts.

The fourth week of December did see the end of Europe Equity Funds’ 41-week outflow streak as flows into Europe Regional Funds hit their highest level in over nine months. At the country level, Spain Equity Funds posted their 19th outflow during the past 20 weeks, redemptions from Sweden Equity Funds hit a 37-week high and investors pulled money out of Austria Equity Funds for the 43rd straight week.

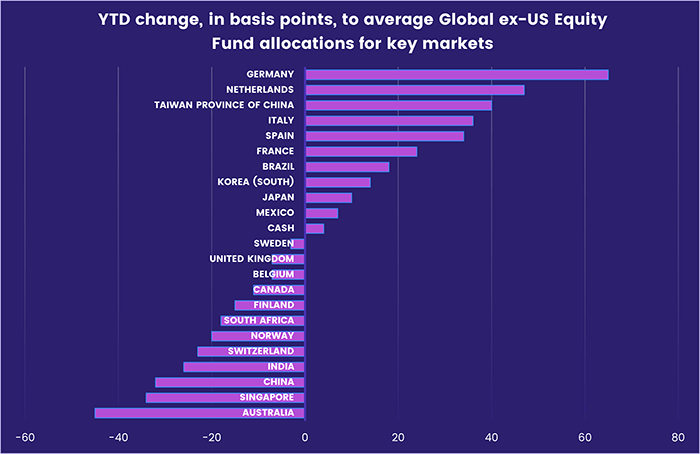

Managers of Global ex-US Equity Funds have shifted exposure this year from Nordic and Emerging Asia countries to core Eurozone and Latin American markets. Of late they and their fully global counterparts have not had much fresh money to allocate. Collectively, Global Equity Funds have chalked up five consecutive outflows and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates have seen money flow out 13 of the past 15 weeks.

Japan Equity Funds recorded their second inflow since the end of October, even though foreign domiciled funds experienced net redemptions for the seventh week running and Japan SRI/ESG Equity Funds posted their biggest weekly outflow since mid-1Q22. The latest sector allocations data for this fund group shows exposure to materials and consumer discretionary stocks at 22 and 28-month highs, respectively, while average weightings for telecoms and consumer staples plays are at 66-month and record lows.

Both of the major North American country groups, US and Canada Equity Funds, recorded solid flows with the latter posting their biggest inflow since the same week last year as retail share classes enjoyed their best week since mid-April. Year-to-date performance for the Canada Equity Funds tracked by EPFR ranges from -19% to +60%.

Global sector, industry and precious metals funds

With many investors on holiday and the next quarterly earnings season still three weeks away, flows to EPFR-tracked Sector Fund groups remained subdued during the week ending Dec. 27. Of the 11 major groups, only three recorded an inflow while the other eight experienced net redemptions ranging from $67 million for Infrastructure Sector Funds to $923 million for Healthcare/Biotechnology Sector Funds.

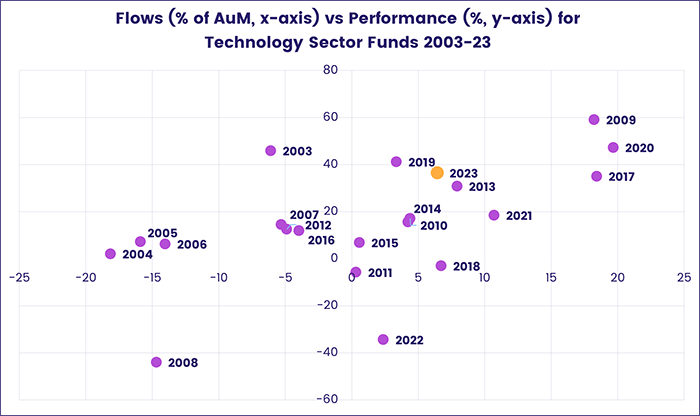

Among the three groups that did attract fresh money were Technology Sector Funds, which chalked up their 36th weekly inflow of a year they started with four straight outflows. After a lull earlier in the quarter, China Technology Sector Funds have taken in fresh money six of the past seven weeks and look set to end the year having absorbed six times the amount that has gone into their US-mandated counterparts.

Also posting inflows were Financial Sector Funds. After racking up 15 consecutive outflows between early August and early November, the group has taken in fresh money five of the past seven weeks as investors anticipate that cheaper money will energize parts of the industry that have struggled with higher interest rates. Drilling down, Regional Bank Funds narrowly extended their longest inflow streak since 2Q21.

Hopes for lower US and European interest rates in the New Year did not translate into positive flows for Real Estate or Consumer Goods Sector Funds, with the latter posting their 12th outflow in the past 14 weeks while Real Estate Sector Funds chalked up their ninth outflow since late October.

Commodities Sector Funds saw money flow out for the sixth straight week as forecasts for 2024 suggest modest declines for agricultural commodity and industrial metal prices and stable energy and precious metal prices.

Bond and other fixed income funds

Flows into EPFR-tracked Bond Funds rebounded in late December to a seven-week high as US, Global, Europe and Canada Bond Funds attracted solid inflows and Emerging Markets Bond Funds snapped their longest run of outflows since 2H08. Year-to-date, Bond ETFs have absorbed nearly four times the amount that went into actively managed funds.

At the asset class level, expectations that US and European interest rates will follow headline inflation lower in the first half of next year helped High Yield Bond Funds attract fresh money for the eighth consecutive week – their longest such run in two years – while Inflation Protected Bond Funds saw over $1 billion redeemed for the fourth time in the past six weeks. Flows to Bank Loan Funds also kicked up a notch, hitting a seven-week high.

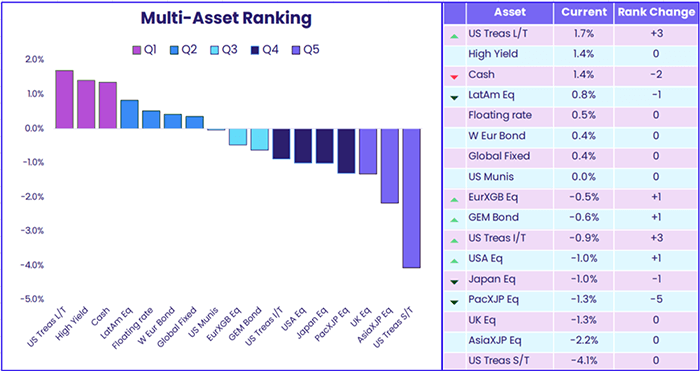

Floating rate and high yield debt are now in the top two quintiles of EPFR’s weekly Multi Asset Rankings, with Latin American equity and cash the only non-fixed income asset classes in those baskets. At the other end of the rankings are short duration US Treasuries, which as recently as late October occupied second place in the rankings.

Among US Bond Funds, this shift from short to long term debt stalled during the latest week, with Short Term Sovereign Bond Funds posting their first inflow since the final week of October and Short Term Corporate Funds their biggest inflow since late July. Long Term US Sovereign Bond Funds, meanwhile, recorded their biggest outflow since late January.

Investors committed fresh money to Europe Bond Funds for the sixth straight week. Funds with corporate mandates attracted more money than their sovereign counterparts for the sixth time in the past seven weeks. At the country level, Italy and Switzerland Bond Funds posted a third consecutive outflow for the first time since 1Q23 and early 4Q22, respectively, while Spain Bond Funds chalked up their 31st inflow since mid-May.

Emerging Markets Bond Funds posted their first inflow since late July and biggest since mid-April as flows into China Bond Funds surged. A week after setting a new inflow record, Sharia EM Bond Funds were hit with their biggest outflow in nearly five months.

Did you find this useful? Get our EPFR Insights delivered to your inbox.