With a growing number of third quarter earnings reports to analyze, US 10-year Treasury yields touching a 17-year high, oil prices rising in tandem with tensions in the Middle East and another Chinese property developer in official default, investors opted for caution during the third week of October. Net flows into all EPFR-tracked Bond Funds and out of Equity Funds equaled 0.03% and -0.03%, respectively, of their total AUM.

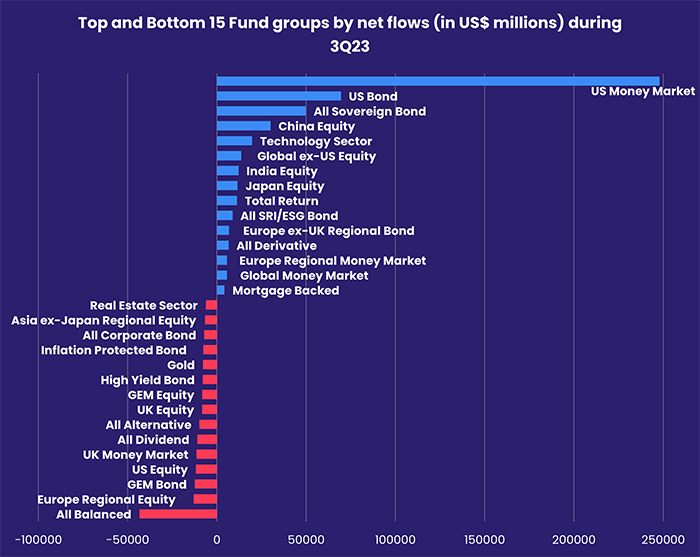

The most striking number for the latest week was the $104 billion outflow recorded by US Money Market Funds, which topped the list for the biggest quarterly inflow during the three months ending September. This is the biggest weekly redemption since EPFR started tracking the group, and appears to be linked to unusually large corporate tax payments and some M&A activity.

Elsewhere, risk reduction again shaped the week’s flows. Both Emerging Markets Equity and Bond Funds experienced net redemptions, Alternative Funds saw money flow out for the fourth week running and investors pulled another $2.4 billion out of High Yield Bond Funds.

Overall, the week ending Oct. 18 saw Alternative Funds post a collective outflow of $1.3 billion while redemptions from Balanced Funds totaled $4 billion and Equity Funds surrendered a net $5.1 billion. Bond Funds posted an inflow of $2 billion.

At the asset class and single country fund level, Convertible Bond Funds experienced net redemptions for the 15th straight week and Inflation Protected Bond Funds for the 40th time in the 42 weeks year-to-date, flows into Mortgage Backed Bond Funds hit a 40-week high and Derivatives Funds extended an inflow streak that started in early August. Korea Bond Funds posted their first outflow since mid-July and their biggest since mid-March, Greece Equity Funds extended their longest redemption streak since a 38-week run ended in early January and India Equity Funds racked up their 31st consecutive inflow.

Emerging markets equity funds

Despite record-setting flows into Emerging Markets Dividend Funds, the week ending October 18 saw Emerging Markets Equity Funds post their second outflow of the third quarter as investors pulled money out of retail share classes for the 11th week running and the diversified Global Emerging Markets (GEM) Equity Funds extended their longest redemption streak since 1H20.

Although the latest data indicates stronger economic growth and Chinese authorities are hinting at additional stimulus measures, China Equity Funds posted consecutive weekly outflows for only the sixth time year-to-date. Investors instead focused on fresh evidence that producers are losing pricing power and the failure of property developer Country Garden to make a payment on its overseas debt before the grace period expired.

Other Asia ex-Japan Country Fund groups fared better, with India, Korea and Taiwan (POC) Equity Funds all pulling in over $400 million during the week. Although higher oil prices are an issue for all three of these economies, which import over 80% of the oil they use, investors opted – at least for now – to look past it.

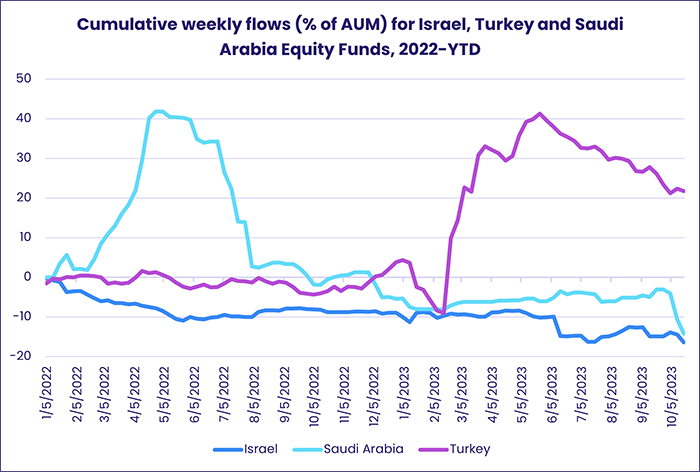

Given that Israel’s reaction to the attack by Hamas terrorists, and the risk that its response will trigger a wider conflict, is driving the latest spike in oil prices, EMEA Equity Funds found it hard to attract fresh money. Collective redemptions from the group climbed to an 11-week high as Saudi Arabia Funds posted their second-largest outflow year-to-date, money flowed out of Turkey Equity Funds for the eighth time in the past 10 weeks and Israel Equity Funds chalked up consecutive weekly outflows for the first time since mid-June.

Brazil Equity Funds, meanwhile, recorded their second inflow since the final week of August. That offset outflows from Mexico, Latin America Regional and Argentina Equity Funds. In the case of the latter, the redemptions were the biggest since early 2Q21 as investors waited for the results of Argentina’s upcoming general election. If the polls are correct, Argentina’s voters will put outspoken libertarian presidential candidate Javier Milei on the path to the Casa Rosada when they go to the polls this weekend.

Developed markets equity funds

Faced with US sovereign yields testing 17-year highs, the risk of wider conflict in the Middle East, a cut in the IMF’s growth forecast for Europe and easing levels of political noise on both sides of the Atlantic, investors’ appetite for developed markets equity remained subdued in mid-October. EPFR-tracked Developed Markets Equity Funds racked up their second consecutive outflow as redemptions from Global, Europe, Japan and Pacific Regional Equity Funds offset modest flows into US and Canada Equity Funds.

For Europe Equity Funds, it was their 32nd consecutive outflow, a run that has shaved their collective AUM by some 4%. During the latest week funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates did extend their longest inflow streak since January and Europe Dividend Funds posted their first inflow since mid-June. But, at the country level, inflows were the exception rather than the rule. Redemptions from France Equity Funds hit an eight-week high, Italy Equity Funds extended their longest outflow streak since 4Q22 and Germany Equity Funds chalked up their 24th outflow over the past six months.

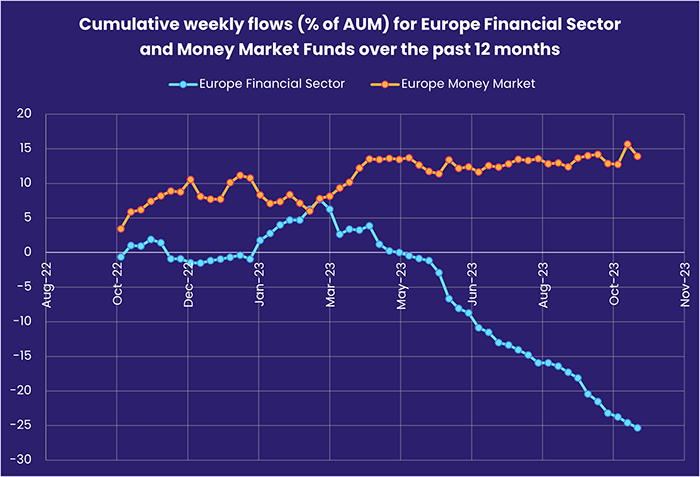

With Europe Money Market Funds offering an increasingly attractive alternative to bank savings products, concerns are mounting that Europe’s banking sector will take a hit from higher funding costs and souring loans. The European Central Bank’s recent decision to stop paying interest on reserves lodged with the ECB has added to the perceived risks that have helped chase over a quarter of their AUM out of Europe Financial Sector Funds.

Japan Equity Funds saw their latest inflow streak come to an end as redemptions hit a 21-week high despite modest inflows into funds domiciled outside Japan. Funds managed for growth chalked up their seventh consecutive outflow and redemptions from Japan Dividend Funds hit a 51-week high. Year-to-date performance among Japan Equity Funds currently ranges from a low of -18.8% to a high of 65%.

Rising borrowing costs and the absence of a speaker in the House of Representatives did not stop US Equity Funds from posting their fourth inflow over the past five weeks. Funds with 3x leverage mandates chalked up their ninth inflow since the beginning of August and US SRI/ESG Funds their ninth in a row. ETFs currently account for 31% of the AUM for all US Equity Funds, up from 25% at the end of 2018.

Global Equity Funds, the largest of the diversified Developed Markets Equity Fund groups, ended the third week of October with their biggest outflow in over two months. For the third week running funds with fully global mandates bore the brunt of the redemptions.

Global sector, industry and precious metals funds

During the week ending Oct. 18, investors found themselves trying to make sense of the same mixture of interest rate calculations, earnings reports and geopolitical events. Not surprisingly, flows for major EPFR-tracked Sector Fund groups moved – with one exception – in the same direction as they did the previous week.

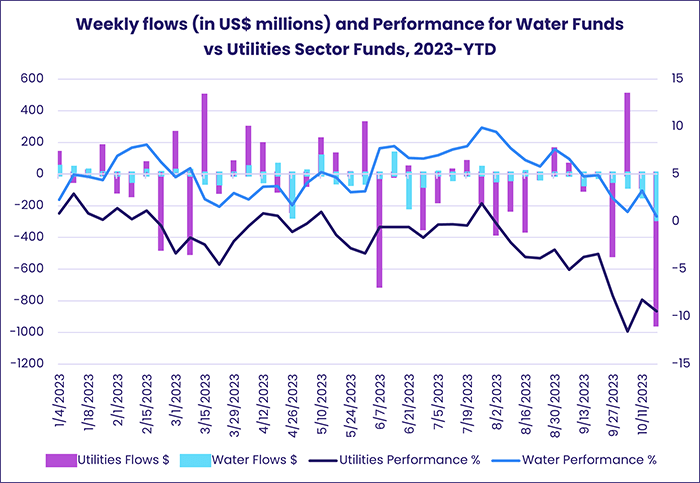

Real Estate Sector Funds were the exception, snapping a three-week inflow streak, as a majority of the 11 major groups posted outflows for the 10th week running. Flows into the four groups recording inflows ranged from $55 million to $565 million while two groups – Healthcare and Utilities Sector Funds – saw over $700 million flow out.

Flows for Utilities Sector Funds sank to their lowest levels since early 2015 – the time of the Flint water crisis – with five of the 10 funds reporting the biggest outflows having water-related mandates. Water Funds experienced their heaviest outflow since late 1Q21, which accounted for 30% of this week’s headline number for all Utilities Sector Funds.

In the face of mixed earnings reports from Netflix (positive subscriber growth) and Tesla (37% drop in earnings), Technology Sector Funds posted their first consecutive weekly outflow since mid-April. But Telecoms Sector Funds enjoyed a second straight week of above-average inflows despite two major European firms, Ericsson and Nokia, flagging a decline in demand for 5G equipment during their third quarter results and pulling their punches when it came to forward guidance.

Healthcare/Biotechnology Sector Funds recorded their eighth consecutive outflow, a run that has seen some $5.1 billion redeemed from these funds. That total is comparable with the net outflow recorded during an 11-week redemption streak that ended the first week of 2Q23. At the country level, investors did steer small sums into funds dedicated to the major Asian markets. Asia ex-Japan and Asia Pacific Healthcare/Biotechnology Sector Funds have seen inflows of $8 billion (or 78% of assets) and $348 million (51% of assets) so far this year while redemptions for North America-dedicated funds (US and Canada) have nearly hit $15 billion.

Bond and other fixed income funds

Investors pulled another $4.5 billion out of Emerging Markets and High Yield Bond Funds in mid-October, bringing combined outflows from both groups over the past five weeks to $24.6 billion, as investors cut risk and rotated more exposure to Sovereign Bond Funds.

It was also another tough week for funds with multi-asset mandates as the threat of higher-for-longer interest rates hitting both equity and bond prices chased investors out of these groups. Balanced Funds, which saw $125 billion flow out in 2022, have seen another $125 billion redeemed during the first nine months of this year. Total Return Funds, meanwhile, chalked up their biggest weekly outflow in exactly a year.

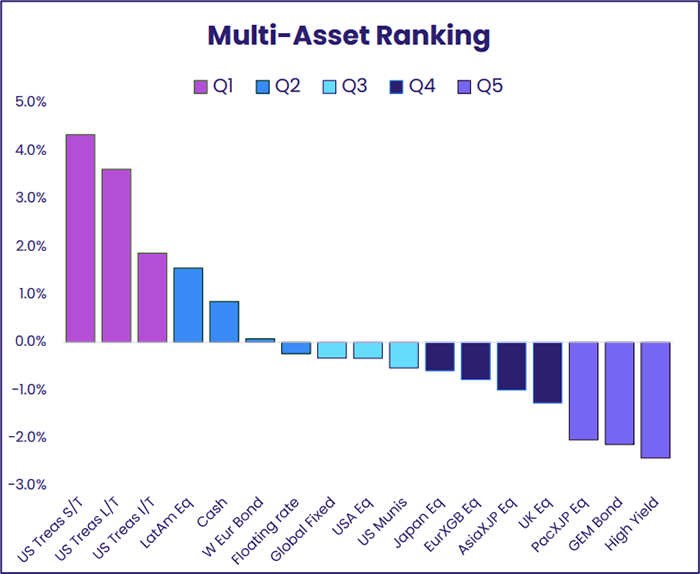

Sovereign Bond Funds absorbed another $1.3 billion as they extended a collective inflow streak stretching back to mid-February. US sovereign debt currently occupies the top three slots in EPFR’s weekly Multi-Asset Rankings.

At the asset class level, Mortgage Backed Bond Funds took in over $1 billion for the first time since mid-January, Inflation Protected Bond Funds posted their 40th outflow in the 42 weeks year-to-date, Municipal Bond Funds extended their longest outflow streak since 2H22 and Bank Loan Funds recorded their 10th inflow since late July.

The latest redemptions from Emerging Markets Bond Funds were equally split between funds with hard and local currency mandates. Frontier Markets Bond Funds posted their third straight week of above-average outflows and redemptions from China and Korea Bond Funds hit six and 30-week highs, respectively.

Flows into Europe Bond Funds bounced back after two straight outflows. Retail share classes attracted fresh money for the sixth week running and funds with socially responsible (SRI) or environmental, social and governance (ESG) mandates racked up their 11th inflow during the past 13 weeks.

Did you find this useful? Get our EPFR Insights delivered to your inbox.