Vikram Srimurthy

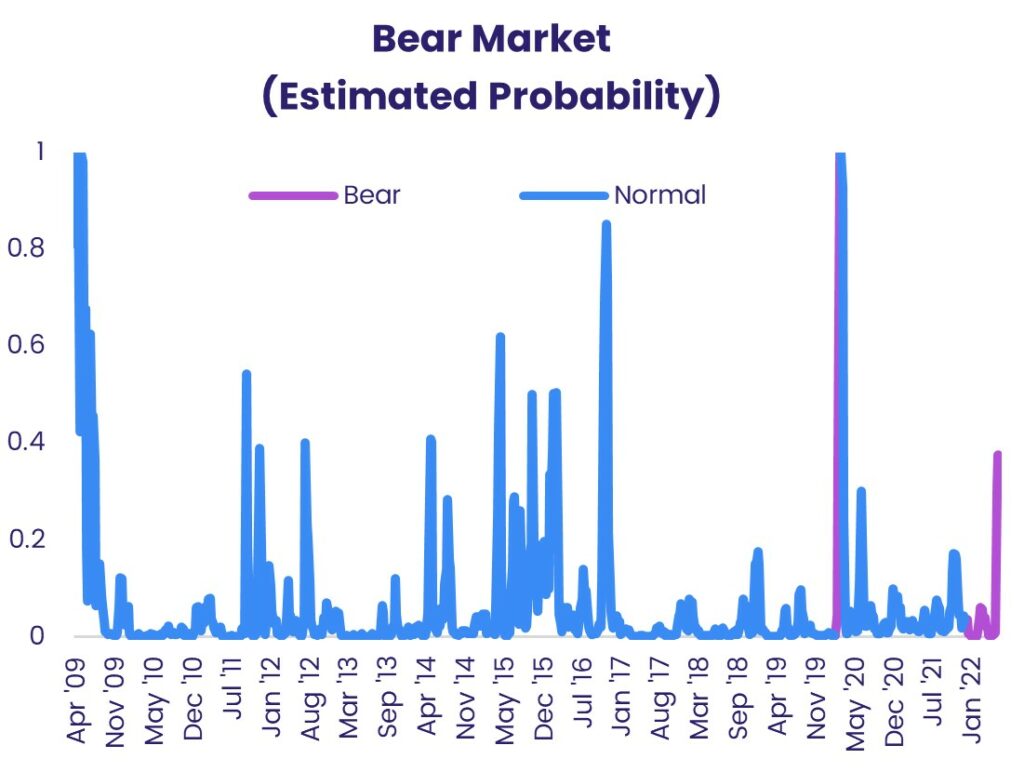

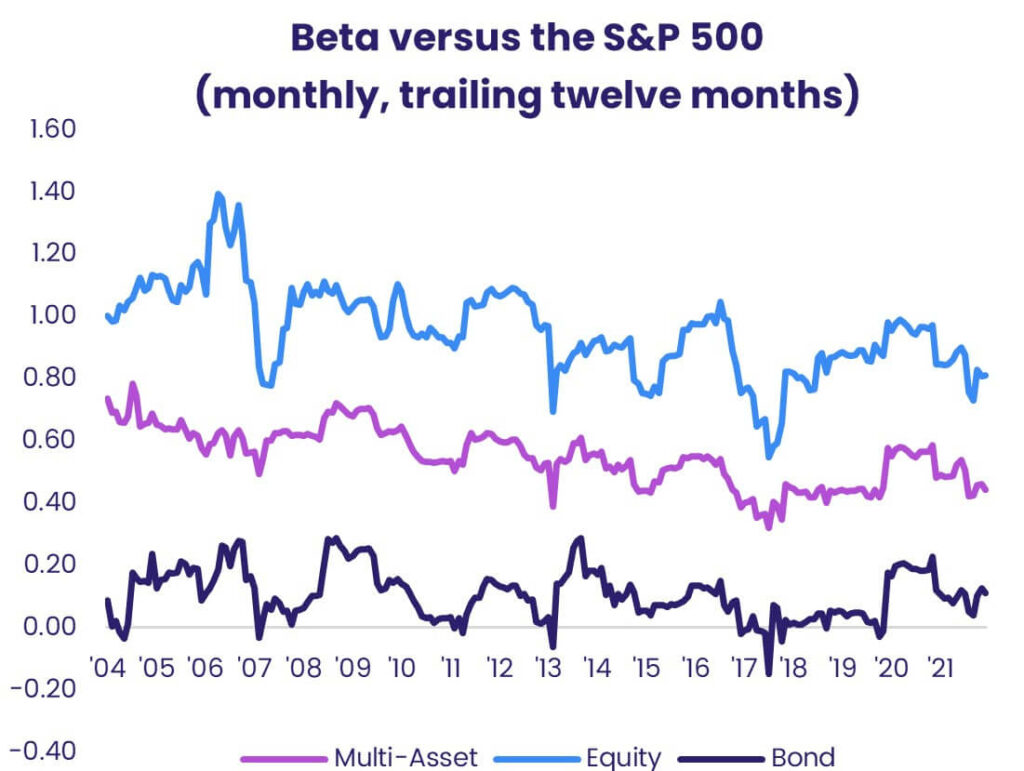

Vik Srimurthy, Senior Quantitative Analyst at EPFR, conducts quantitative research behind all of EPFR’s current products, focusing primarily on FX and stock flows, to help financial services firms detect money movements and seize market opportunities. Specifically, he helps clients understand how they can gain a competitive edge by using EPFR data to expose market conditions with tools such as the “Bear Detector,” designed to predict bear markets two to three weeks before they arrive.

Additionally, Vikram built the quantitative capabilities of the EPFR research infrastructure, allowing him to revamp all its fund flow models. He demonstrates the efficacy of EPFR data in peer-reviewed journals, educates clients on new research, and uses client feedback to drive further research.

Prior to joining EPFR, Vikram worked as a portfolio manager for LMCG Investments, LLC, managing over $1 billion in emerging markets assets as part of the quantitative equity investment management group. He also served on the buy-side quantitative team at Evergreen Investments.

Outside the office, Vikram, a native of India, spends time training his terrier mix, Koko, and playing bridge competitively.

B.A., Mathematics; Dartmouth College Ph.D., Mathematics - University of California, San Diego.

“I build the tools that help people outperform the markets. We know our tools help people outperform the markets because we have the data to show it. With our fund flows and country allocations, we can isolate FX trends and understand what’s driving them. And with a clear view, we have predictive power.”

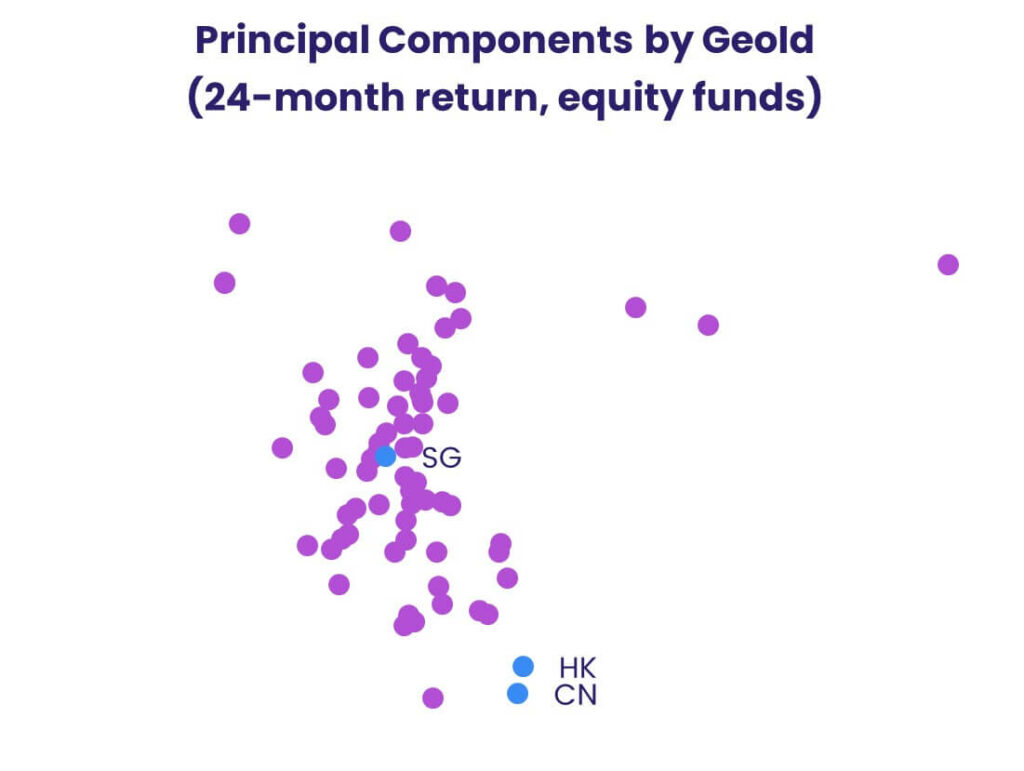

Hong Kong and Singapore: A tale of two cities

Predicting bear markets – before they are in your trash can

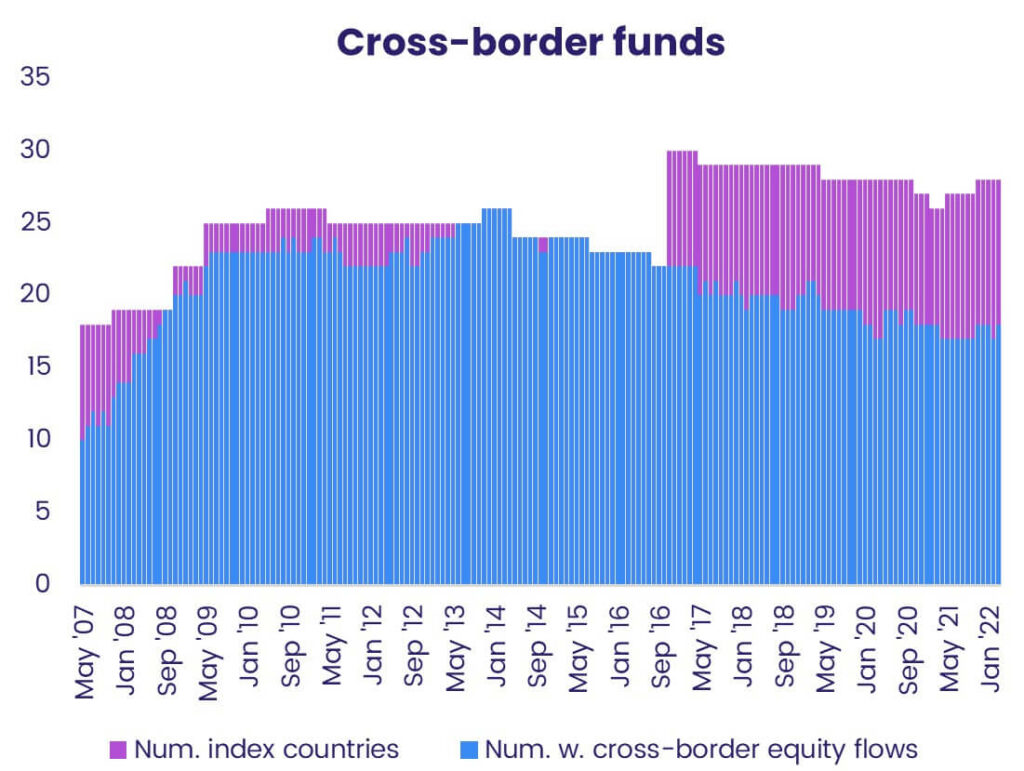

Quants Corner – Treading carefully along the frontier

Seeking balance in an underused fund group

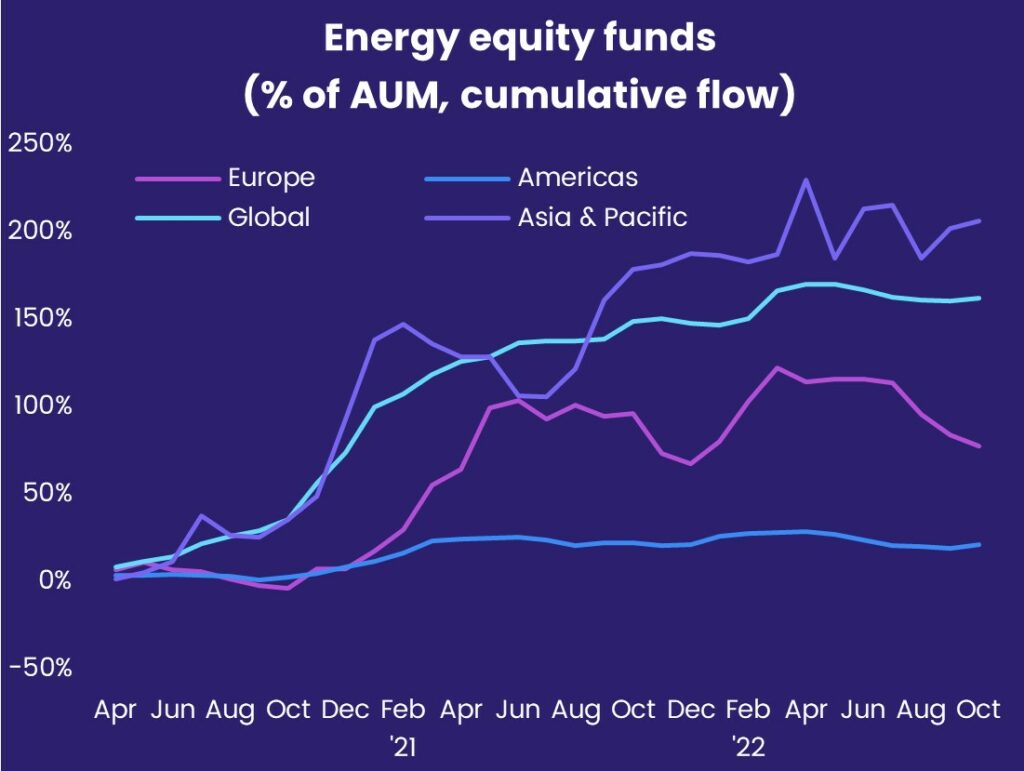

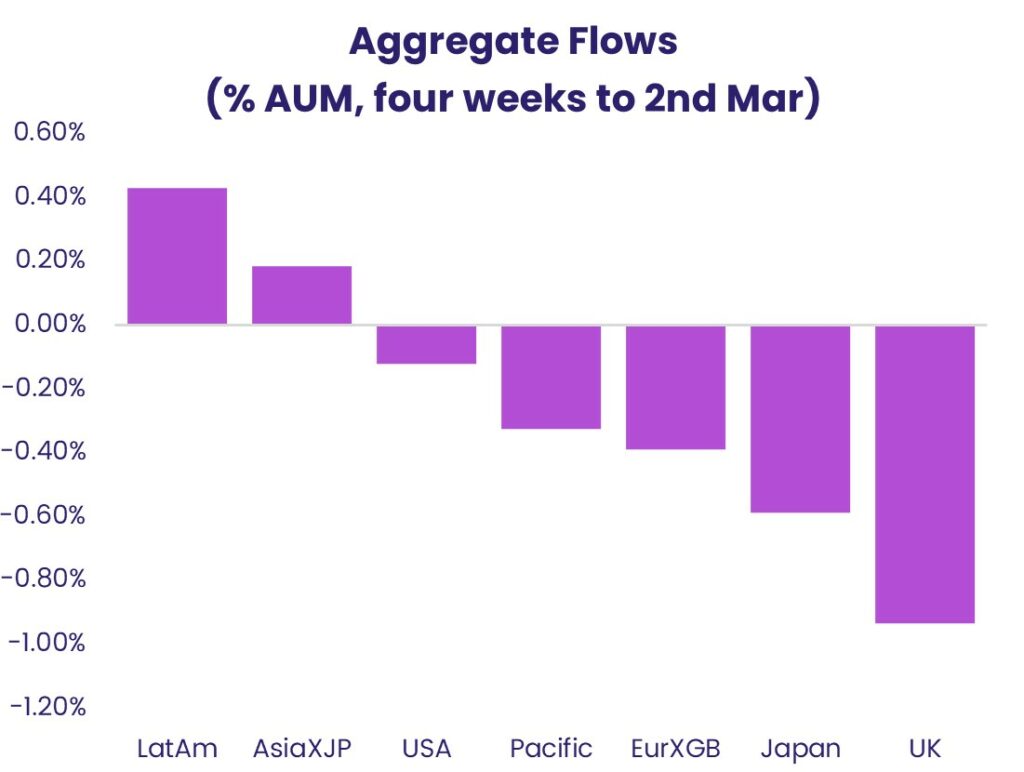

Regional strategy: Old wine in a new bottle

EPFR Exchange Podcast, Special Focus: Fixed Income Barometer

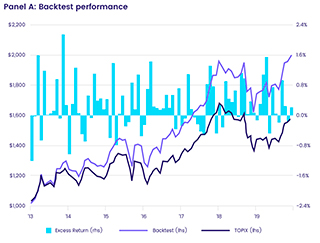

A rising tide lifts some (Japanese) boats: The Bank of Japan’s ETF purchases and their impact on market signals for individual stocks

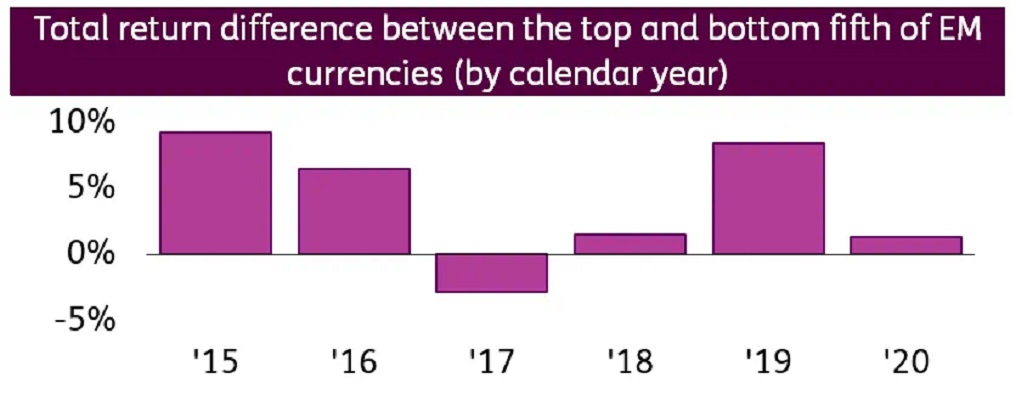

Quants Corner – Trick? Treat? Or contrarian FX signal?

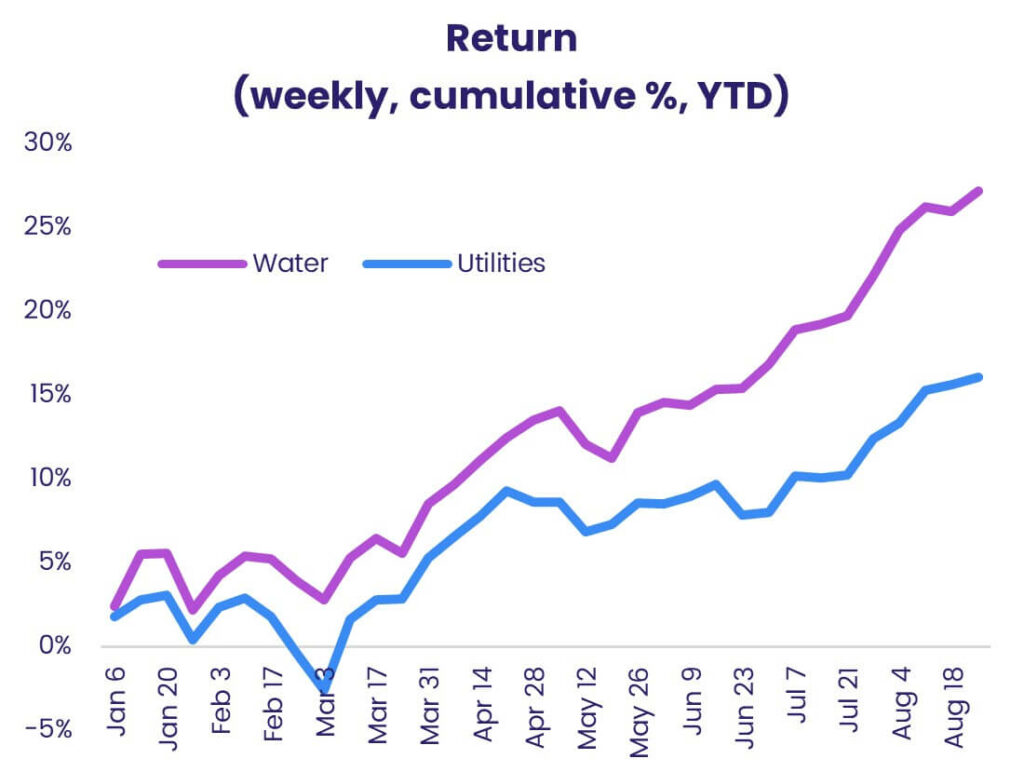

Quants Corner – The utility of water has never been clearer

Quants Corner – Cruising to Alpha